When a marriage ends in divorce, one of the most complex and emotionally charged issues is the division of joint property. In 博鱼体育官方网站, this process is governed by specific legal guidelines that aim to ensure a fair distribution of assets. If you're going through a divorce or planning ahead, understanding your rights regarding matrimonial property is essential.

What Is Considered Joint or Matrimonial Property?

Under 博鱼体育官方网站n law, joint property鈥攁lso known as matrimonial assets鈥攔efers to assets acquired by either spouse during the marriage. These include:

Real estate (houses, apartments, land)

Vehicles

Business interests

Savings and fixed deposits

EPF (Employees Provident Fund)

Furniture and household items

Even if the property is in one spouse鈥檚 name, it may still be classified as joint property if the other spouse contributed financially or played a role in its maintenance or improvement.

Legal Basis: Law Reform (Marriage and Divorce) Act 1976

The Law Reform (Marriage and Divorce) Act 1976, specifically Section 76, provides the framework for dividing matrimonial assets in 博鱼体育官方网站. It empowers the court to order a just and equitable division of property upon divorce.

Section 76(1): Jointly Acquired Assets

For assets acquired jointly during the marriage, the court considers both direct contributions (like financial input) and indirect contributions (like household management and childcare).

Section 76(3): Solely Acquired Assets

If one spouse acquired property in their own name, the other spouse may still be entitled to a share if they made indirect contributions, such as homemaking or raising children.

How Is Joint Property Divided Upon Divorce?

There is no fixed formula, but the division is based on a case-by-case basis, taking into account:

Financial contributions from both parties

Non-financial contributions (e.g. caring for the family or managing the home)

The length of the marriage

Sacrifices made by either party (e.g. quitting a job to care for children)

The welfare of any children from the marriage

Typical Division Ratios

50:50 鈥� Common in long marriages where both parties contributed.

60:40 or 70:30 鈥� Possible if one spouse made more substantial financial contributions but the other played a major indirect role.

100:0 鈥� Rare, usually applicable when there was no contribution at all from one party.

What If the Property Is in Only One Name?

Even if the property is registered under only one spouse鈥檚 name, it can still be classified as matrimonial property if the other spouse can prove:

Financial contribution to the purchase

Indirect contributions (e.g. homemaking, child-rearing)

Shared enjoyment or use of the property

The court will assess the nature of the contributions before deciding on the division.

Division of Jointly Owned Property (Under Both Names)

For property held under joint names, the court typically starts with a presumption of equal ownership. If either party seeks a larger share, they must provide evidence showing unequal contribution.

Can Division of Property Be Settled Out of Court?

Yes, couples can mutually agree on how to divide their assets and record the agreement in a consent order, which is legally binding. This approach saves time, legal costs, and emotional strain.

You can also consider mediation as an alternative method to reach a fair settlement.

Final Thoughts

Dividing joint property during divorce in 博鱼体育官方网站 is not a simple 50-50 matter. The court will evaluate both financial and non-financial contributions made by each spouse throughout the marriage. Whether the assets are in your name or your spouse鈥檚, you may still have a legal right to claim your fair share.

If you're facing a divorce, it's strongly advised to consult a family lawyer to understand your position and protect your rights.

]]>

When most people think about buying property, their minds immediately jump to the dream home鈥攁 spacious living room, a cozy master bedroom, or a beautiful kitchen perfect for family gatherings. But if building long-term wealth and achieving financial freedom are part of your goals, then investing in real estate first may be a smarter move than buying your dream home upfront.

In this article, we鈥檒l explore why property investment should come before your dream home and how this strategy can accelerate your journey to financial success.

1. Real Estate Investment Generates Passive Income

Unlike a dream home, which is an expense, an investment property can generate rental income every month. This income can help you pay off the loan, cover maintenance costs, and even fund other investments.

Imagine owning a high-demand apartment in Kuala Lumpur or a short-term rental in a tourist hotspot like Bukit Bintang鈥攖hese properties can yield attractive returns that move you closer to financial independence.

2. Capital Appreciation Builds Your Net Worth

Property values tend to appreciate over time, especially in growth areas. By buying an investment property early, you can enjoy capital gains that increase your net worth鈥攕omething a dream home cannot offer in the same way since it鈥檚 not income-generating.

Investing in real estate in upcoming locations like TRX, Mont Kiara, or Bangsar South means your asset could grow in value significantly by the time you鈥檙e ready to buy your dream home.

3. Leverage Works in Your Favor

Real estate allows you to use leverage, meaning you can borrow money to buy property and let the tenant help pay the mortgage. This powerful wealth-building tool enables you to control a large asset with a smaller capital outlay.

In contrast, when you buy a dream home first, you tie up your cash and limit your borrowing capacity for future investments.

4. Flexibility and Financial Freedom

When you prioritize investing, you give yourself more options down the road. You can:

Refinance your investment property to fund your dream home

Use the cash flow to cover lifestyle upgrades

Sell the investment and use the profit as a large down payment

This strategy gives you flexibility, while buying your dream home first locks you into a fixed lifestyle and financial commitment.

5. Emotional vs Financial Decision

Buying a dream home is often an emotional decision鈥攍ocation, design, and lifestyle come into play. Investment, however, is a strategic decision focused on ROI, rental yield, and market growth.

By approaching property logically first, you build a foundation of wealth that allows you to later purchase your ideal home without financial strain.

Final Thoughts: Build Wealth First, Then Build Your Dream

To sum it up, while owning your dream home is a wonderful milestone, it shouldn鈥檛 necessarily be your first one. By investing in real estate first, you create financial security, grow your capital, and open up more options for your future.

鉁� Start small

鉁� Choose the right investment location

鉁� Let your property work for you

Once your investments generate sufficient income or capital, you can afford your dream home鈥攁nd still have passive income flowing in.

]]>

Imagine this: You鈥檝e just moved into your dream home, the Defect Liability Period (DLP) has ended, and you鈥檙e finally settling in. Then, out of nowhere, you hear a loud whoosh鈥攚ater is gushing from a burst pipe, flooding your living room. Sounds like a nightmare, right? Unfortunately, this scenario is all too common in 博鱼体育官方网站, where pipe bursts during or after the DLP can turn your dream home into a watery disaster.

But don鈥檛 panic just yet! In this article, we鈥檒l dive into why pipe bursts happen, how to prevent them, and what to do if you find yourself ankle-deep in water. Let鈥檚 get started!

What is the Defect Liability Period (DLP)?

The Defect Liability Period (DLP) is like a safety net for homeowners. It鈥檚 a warranty period鈥攗sually 12 to 24 months鈥攁fter your property is completed, during which the developer is responsible for fixing any defects. This includes everything from cracked tiles to leaky pipes. But here鈥檚 the catch: once the DLP ends, you鈥檙e on your own. That鈥檚 why it鈥檚 crucial to ensure everything is in tip-top shape before the clock runs out.

Why Do Pipe Bursts Happen During or After the DLP?

Pipe bursts don鈥檛 just happen out of the blue. They鈥檙e often the result of underlying issues that were overlooked or ignored. Here are the usual suspects:

Shoddy Workmanship

Let鈥檚 face it鈥攏ot all contractors are created equal. Poorly installed pipes, loose joints, or insufficient support can lead to leaks or bursts over time.

Cheap Materials

Some developers cut corners by using low-quality pipes that can鈥檛 withstand 博鱼体育官方网站鈥檚 humid climate or fluctuating water pressure. These pipes are like ticking time bombs.

Soil Settlement

After construction, the ground settles, which can shift or crack underground pipes. It鈥檚 like the earth is playing a cruel joke on your plumbing system.

Water Pressure Woes

Ever experienced a sudden surge in water pressure? It鈥檚 not just annoying鈥攊t can also strain your pipes, causing them to burst.

Ignored Red Flags

Small leaks or damp spots during the DLP might seem minor, but if left unchecked, they can escalate into full-blown pipe bursts.

How to Prevent Pipe Bursts

Prevention is always better than cure. Here鈥檚 how you can protect your home from pipe bursts:

Inspect, Inspect, Inspect

During the DLP, keep a close eye on your plumbing system. Look for signs of leaks, corrosion, or dampness. Don鈥檛 hesitate to report even the smallest issues to your developer.Demand Quality Materials

If you鈥檙e buying a new property, ask about the type of pipes used. Opt for durable materials like high-density polyethylene (HDPE) or copper.Test Water Pressure

Install a pressure regulator to keep water pressure in check. This simple device can save you from a world of trouble.Address Soil Issues

If your property is built on unstable soil, consider using flexible pipes that can withstand ground movement.Don鈥檛 Wait Until It鈥檚 Too Late

If you notice a leak or damp spot, act fast. A small repair during the DLP can save you from a major disaster later.

What to Do If a Pipe Bursts

If the worst happens, don鈥檛 panic. Follow these steps to minimize the damage:

Shut Off the Water Supply

Locate the main water valve and turn it off immediately. This will stop the flow of water and prevent further damage.Call for Help

If the DLP is still active, contact your developer or contractor right away. If the DLP has ended, call a licensed plumber to fix the issue.Document Everything

Take photos and videos of the damage for insurance claims or legal purposes. If the burst is due to poor workmanship, you may have grounds for compensation.Dry Out the Area

Use towels, mops, or a wet vacuum to remove standing water. Open windows and use fans to speed up the drying process and prevent mold growth.Learn from the Experience

Once the crisis is over, take steps to prevent future pipe bursts. Consider upgrading your plumbing system or installing leak detection devices.

The Bigger Picture: Developers vs. Homeowners

Pipe bursts are often a result of miscommunication or negligence. Developers must prioritize quality workmanship and materials, while homeowners need to stay vigilant during the DLP. By working together, we can reduce the risk of pipe bursts and ensure that homes in 博鱼体育官方网站 are safe, durable, and leak-free.

Final Thoughts

A pipe burst can feel like a disaster, but with the right knowledge and precautions, it鈥檚 a disaster you can avoid. Whether you鈥檙e a new homeowner or a seasoned property owner, understanding the causes and solutions for pipe bursts is essential. Don鈥檛 wait until it鈥檚 too late鈥攖ake action today to protect your home and your peace of mind.

Remember, your home is your sanctuary. Let鈥檚 keep it safe, dry, and burst-free!

]]>

博鱼体育官方网站鈥檚 real estate market is evolving rapidly, and one of the most exciting trends gaining traction is the Dual Key Property Concept. Whether you鈥檙e a homeowner, investor, or part of a multi-generational family, dual key properties offer a unique blend of flexibility, income potential, and modern living. But are they the right choice for 博鱼体育官方网站ns? In this article, we鈥檒l explore the pros and cons of dual key properties in 博鱼体育官方网站 to help you make an informed decision.

What is a Dual Key Property?

A dual key property is a single housing unit with two separate living spaces, each featuring its own entrance, kitchen, and bathroom. Think of it as a duplex under one roof, but more compact and efficient. This concept is particularly popular in urban areas like Kuala Lumpur, Penang, and Johor Bahru, where space is at a premium, and homeowners are looking for innovative ways to maximize their property鈥檚 potential.

For example, a dual key property might include a main unit for the homeowner and a smaller, self-contained unit that can be rented out or used by family members.

The Pros of Dual Key Properties in 博鱼体育官方网站

Rental Income Potential

With 博鱼体育官方网站鈥檚 growing demand for rental properties, dual key homes offer an excellent opportunity to generate passive income. Homeowners can rent out the secondary unit while living in the main space, helping to offset mortgage payments or supplement their income. This is especially appealing in high-demand areas like Kuala Lumpur and Penang, where rental yields are attractive.

Ideal for Multi-Generational Families

In 博鱼体育官方网站, where multi-generational living is common, dual key properties provide the perfect balance of togetherness and privacy. Aging parents, adult children, or extended family members can live close by while maintaining their independence. This makes dual key properties a popular choice for 博鱼体育官方网站n families.

Higher Property Value

Dual key properties are often seen as a smart investment due to their versatility and income potential. They tend to have higher resale value, especially in high-demand areas like Klang Valley and Iskandar 博鱼体育官方网站.

Flexibility for Changing Needs

Whether you need a home office, a guest suite, or a space for a live-in caregiver, dual key properties offer flexibility to adapt to your lifestyle. This is particularly useful for young professionals, growing families, or retirees in 博鱼体育官方网站.

Tax Incentives for Property Owners

In 博鱼体育官方网站, homeowners may qualify for tax deductions on expenses related to the rental portion of the property, such as maintenance and utilities. This makes dual key properties even more attractive for investors.

The Cons of Dual Key Properties in 博鱼体育官方网站

Higher Initial Cost

Dual key properties typically come with a higher price tag compared to traditional homes. The additional features, such as separate entrances and utilities, can increase construction or purchase costs.

Maintenance and Tenant Management

Renting out the secondary unit means taking on the responsibilities of a landlord, including maintenance, tenant management, and legal obligations. This can be time-consuming and stressful for some homeowners.

Limited Privacy

While dual key properties offer separate living spaces, they are still part of the same building. This can lead to noise and privacy concerns, especially if the walls are not well-insulated.

Zoning and Legal Restrictions

Not all areas in 博鱼体育官方网站 allow dual key properties due to zoning laws or building regulations. It鈥檚 essential to check with local authorities or consult a real estate expert before investing.

Market Dependency

The success of renting out the secondary unit depends heavily on the local rental market. In areas with low demand or oversupply, finding reliable tenants can be challenging.

Why Dual Key Properties are Gaining Popularity in 博鱼体育官方网站

Urbanization and Space Constraints

As 博鱼体育官方网站鈥檚 urban areas continue to grow, space is becoming increasingly limited. Dual key properties offer a practical solution for maximizing space while meeting the needs of modern families and investors.

Rising Demand for Rental Properties

With the increasing cost of living and growing expatriate community, the demand for rental properties in 博鱼体育官方网站 is on the rise. Dual key homes allow homeowners to tap into this lucrative market.

Cultural Preference for Multi-Generational Living

In 博鱼体育官方网站, it鈥檚 common for families to live together under one roof. Dual key properties provide a modern twist on this tradition, offering privacy and independence while keeping loved ones close.

Who Should Consider a Dual Key Property in 博鱼体育官方网站?

Investors: Looking for a property that generates rental income while appreciating in value.

Multi-Generational Families: Seeking a balance between togetherness and privacy.

First-Time Homebuyers: Interested in offsetting mortgage costs by renting out a portion of their home.

Empty Nesters: Wanting to downsize while keeping space for visiting family or guests.

Final Thoughts

The Dual Key Property Concept is reshaping 博鱼体育官方网站鈥檚 real estate landscape, offering a unique combination of flexibility, income potential, and modern living. However, like any investment, it鈥檚 essential to weigh the pros and cons carefully and consider your long-term goals.

Whether you鈥檙e an investor, a growing family, or someone looking for a creative housing solution, dual key properties could be the key to unlocking your dream lifestyle in 博鱼体育官方网站.

]]>

Real Property Gains Tax (RPGT) is a levy imposed by the 博鱼体育官方网站n government on profits derived from the sale of real estate assets. The tax rate is contingent upon the duration for which the property has been held by the owner.

As of January 1, 2022, individuals who are 博鱼体育官方网站n citizens or permanent residents are exempt from RPGT when disposing of properties held for more than five years. This adjustment reduces the RPGT rate to 0% for such disposals, a change introduced in Budget 2022.

RPGT Rates for 博鱼体育官方网站n Citizens and Permanent Residents:

Property held for up to 3 years: 30%

Property held for 4 years: 20%

Property held for 5 years: 15%

Property held for more than 5 years: 0%

RPGT Rates for Non-Citizens and Companies:

Property held for up to 5 years: 30%

Property held for more than 5 years: 10%

Calculating RPGT:

To determine the chargeable gain:

Selling Price minus Purchase Price

Subtract any Allowable Expenses, such as legal fees, stamp duty, and renovation costs.

Example Calculation:

If an individual sells a property after 4 years:

Purchase Price: RM500,000

Selling Price: RM700,000

Allowable Expenses: RM20,000

Chargeable Gain:

RM700,000 (Selling Price) - RM500,000 (Purchase Price) = RM200,000

RM200,000 - RM20,000 (Allowable Expenses) = RM180,000

For a property held for 4 years, the RPGT rate is 20%.

RPGT Payable:

RM180,000 x 20% = RM36,000

Exemptions:

One-time exemption for 博鱼体育官方网站n citizens or permanent residents on gains from the disposal of a private residence.

Transfers between family members, such as spouses, parents, and children, are exempt from RPGT.

It's essential to stay updated with the latest regulations, as tax policies can change. For comprehensive details, refer to official resources or consult with tax professionals.

]]>

The Stability of Homeownership

Homeownership is often associated with stability and security. When you buy a home, you're investing in an asset that can appreciate over time, providing a sense of permanence and financial security. Here are some key benefits of committing to homeownership:

Equity Building: As you make mortgage payments, you build equity in your home, which can be a significant financial asset in the future.

Tax Benefits: Homeowners may enjoy tax deductions on mortgage interest and property taxes, which can reduce your taxable income.

Control and Customization: Owning a home allows you to make modifications and improvements without needing approval from a landlord.

Long-Term Savings: While initial costs are high, homeownership can lead to long-term savings, especially if property values rise.

However, homeownership also comes with responsibilities such as maintenance, property taxes, and the risk of market fluctuations. It's a significant commitment that requires careful consideration.

The Flexibility of Renting

Renting offers a different set of advantages, particularly for those who value flexibility and don't want to be tied down by the responsibilities of homeownership. Here are some benefits of renting:

Lower Upfront Costs: Renting typically requires a security deposit and the first month's rent, making it more accessible for those without substantial savings.

No Maintenance Responsibilities: Landlords are usually responsible for repairs and maintenance, freeing you from the burden of handling these issues.

Flexibility to Move: Rental agreements often have shorter terms, allowing you to move more easily if your job or personal life changes.

No Risk of Property Value Fluctuations: Renters are not affected by changes in the real estate market, which can be volatile.

However, renting means you don't build equity, and there's no guarantee that rent won't increase over time, which can lead to higher housing costs in the future.

The decision to rent or buy a home is a personal one that depends on your individual circumstances. If you value stability, long-term investment, and control over your living space, homeownership might be the right choice for you. On the other hand, if you prefer flexibility and want to avoid the responsibilities that come with owning a home, renting could be more suitable.

Ultimately, consider your financial situation, future plans, and lifestyle preferences to determine whether renting or committing to the stability of homeownership aligns better with your goals.

]]>Ready to buy your first property? Before diving into the property market, there鈥檚 one crucial factor you鈥檒l need to master: B U D G E T. Understanding your finances and planning ahead is the foundation for a successful and stress-free home-buying journey.

What Comes First: The Loan or the Property?

Many first-time buyers wonder: Should I look for a property first or apply for a loan?

The answer? Start by assessing your finances and understanding how much you can borrow. Pre-qualifying for a loan allows you to set realistic expectations and avoid disappointment.

For example: If you fall in love with a property priced at RM900,000 but the bank approves only RM700,000, you鈥檒l face a tough decision. Either come up with RM200,000 out of pocket or let it go.

How Much Do You Need to Earn to Afford a RM900,000 Property?

Down payment (10%): RM90,000

Loan amount (90%): RM810,000

Gross annual income required: RM140,000

This calculation assumes no other monthly debt, a 30-year loan term, and an interest rate of 3.2%.

Essential Costs of Buying a Property

To budget effectively, you need to be aware of the costs associated with purchasing a home. Here鈥檚 a breakdown:

Earnest deposit:

2% of the agreed purchase price.

Down payment:

10% of the agreed purchase price (including earnest deposit).

Sale and Purchase Agreement (SPA):

Includes legal fees, stamp duty, and legal disbursement costs.

Loan agreement:

Covers legal fees, stamp duty, and legal disbursement costs.

Real estate agent鈥檚 commission:

Maximum of 3% of the property鈥檚 sale price.

Valuation fee:

Ranges from 0.25% to 0.04% of the sub-sale property鈥檚 value.

Transfer of ownership (MOT):

Cost depends on the property price tier.

Government tax on legal agreements:

6% of the lawyer鈥檚 total fees.

Bank processing fee:

Between RM50 and RM200.

Perfection of Transfer (POT):

Covers MOT legal fees, stamp duty, and disbursement costs.

Perfection of Charge (POC):

Similar to POT but stamp duty is fixed at RM40.

Quit rent and assessment fees:

Quit rent: Based on property size (per square foot).

Assessment fees: Calculated based on the property鈥檚 estimated annual rental value.

Maintenance fee and sinking fund (for strata properties):

Maintenance fee: Shared cost, calculated based on development factors.

Sinking fund: Typically 10% of the maintenance fee.

Mortgage insurance:

Premiums depend on the type of coverage chosen.

Utilities:

Includes water, electricity, sewerage, and Internet services.

Renovations:

Should not exceed six times your monthly household income.

Save Smarter for Your First Property

Owning your dream home means making smarter financial decisions:

Trim unnecessary expenses:

Skip luxury gadgets or non-essential purchases.

Avoid car loans if possible:

A car鈥檚 value depreciates 10% the moment it鈥檚 driven out of the showroom. This limits your housing loan eligibility.

Build an emergency fund:

Unexpected expenses like renovations, maintenance fees, or legal charges can add up.

Key Takeaways for First-Time Home Buyers

Start with your finances: Pre-qualify for a loan before shopping for properties.

Understand all associated costs: From legal fees to maintenance charges, budget for the unexpected.

Cut down on liabilities: The fewer loans you have, the better your chances of getting a higher housing loan.

In the hustle and bustle of Kuala Lumpur's vibrant streets, amidst the towering skyscrapers and bustling markets, lies a forgotten gem that serves as the very heartbeat of the city's connectivity and convenience.

this gem is none other than the KL Sentral transportation hub. It is a transit-oriented development that serves as the main railway station of Kuala Lumpur, the capital of 博鱼体育官方网站. Opened on April 16, 2001, KL Sentral replaced the old Kuala Lumpur railway station, becoming the largest railway station in 博鱼体育官方网站 and Southeast Asia until 2021.

This article delves into the significance, features, and offerings of KL Sentral.

A Hub of Connectivity

As 博鱼体育官方网站's largest transit hub, KL Sentral plays a pivotal role in connecting the city to the rest of the country and beyond. From here, commuters can seamlessly hop onto trains, buses, and even planes, embarking on journeys that span the length and breadth of 博鱼体育官方网站. Whether it's a leisurely weekend getaway to Penang or a business trip to Singapore, KL Sentral serves as the starting point for countless adventures.

But its significance extends far beyond domestic travel. With the introduction of the KLIA Ekspres and KLIA Transit services, KL Sentral has become the gateway to the world, offering travellers swift and convenient access to Kuala Lumpur International Airport. International visitors arriving at KLIA can now hop on a train and find themselves in the heart of the city within minutes, bypassing the notorious traffic jams that plague the city's streets.

A Beacon of Convenience

Beyond its role as a transportation hub, KL Sentral is a testament to the city's commitment to convenience and modernity. Here, commuters can find an array of amenities at their fingertips, from shopping malls and restaurants to hotels and office spaces. Need to grab a quick bite before catching your train? No problem. Looking to unwind after a long day of meetings? There's no shortage of options for entertainment and relaxation.

Moreover, KL Sentral's integration with various modes of transportation, including the LRT, MRT, and monorail systems, makes it a breeze to navigate the city without ever having to rely on a car. With climate change and sustainability at the forefront of global concerns, the importance of efficient public transportation cannot be overstated, and KL Sentral stands as a shining example of what can be achieved when cities prioritise accessibility and connectivity.

Why KL Sentral is a Smart Investment?

The Strong Rental Market in KL Sentral

KL Sentral's strategic location as the nucleus of Kuala Lumpur鈥檚 transportation network makes it a prime spot for residential and commercial properties. The area鈥檚 unparalleled connectivity, coupled with its bustling business environment, has fostered a robust rental market. Professionals and expatriates constantly seek high-quality accommodation close to their workplaces, ensuring consistent demand for rental properties. For instance, an investor who owns a 2-bedroom apartment in one of KL Sentral鈥檚 modern high-rise buildings can easily find tenants among the numerous employees working in nearby multinational corporations. This constant demand ensures a steady income stream, making it an attractive option for property investors.

Consider an example: With the influx of multinational companies and their employees, the demand for such high-end accommodations remains high, ensuring that rental properties are rarely vacant. Moreover, the amenities and lifestyle options available in KL Sentral further enhance its appeal, making it a preferred choice for discerning tenants.

Capital Appreciation

Properties in KL Sentral have shown significant capital appreciation over the years, driven by continuous development and economic growth. This rising property value offers substantial returns for long-term investors. For instance, a commercial office space purchased in 2010 for MYR 2 million might now be worth over MYR 4 million due to the development of new infrastructure, improved amenities, and increased business activity in the area.

Similarly, residential properties have also experienced impressive capital appreciation. Take, for example, a luxury condominium in Suasana Sentral Loft. Purchased for MYR 1.5 million a decade ago, its value could now easily exceed MYR 2 million, reflecting the area鈥檚 enhanced attractiveness and development. The steady increase in property values ensures that investors can expect significant returns on their investments over time.

Additionally, government and private sector investments in infrastructure and commercial projects continue to bolster property values. New developments, such as expanded public transportation lines and commercial complexes, contribute to the area's desirability, promising further capital appreciation in the future. This continuous upward trajectory in property values makes KL Sentral a prime location for those looking to maximize their investment returns.

High Demand

The combination of KL Sentral's prime location, excellent infrastructure, and robust rental market creates a high demand for properties, translating into higher property values and better returns on investment. For instance, an investor who owns a serviced apartment in KL Sentral can expect high occupancy rates and attractive rental yields. The continuous influx of professionals and expatriates ensures that there is always a market for well-located, high-quality properties.

Even in fluctuating market conditions, the demand for properties in KL Sentral remains strong, making it a relatively safe investment choice.

Supply and Demand Dynamics

KL Sentral benefits from a balanced supply and demand dynamic, particularly in comparison to areas like KLCC (Kuala Lumpur City Centre). While KLCC has seen extensive development, resulting in a larger supply of properties, KL Sentral maintains a more controlled development pace. This controlled growth helps sustain property values and rental rates by preventing oversupply, which can dilute market demand and rental yields.

The steady demand for properties in KL Sentral ensures high occupancy rates and competitive rental yields without the intense competition seen in more saturated markets. Moreover, the area鈥檚 status as a transportation hub and business district continues to attract both local and international tenants, further supporting rental demand and investment stability.

Investing in property in KL Sentral is a strategic move for those looking to capitalize on the area鈥檚 strong rental market, significant capital appreciation, and high demand. The area's unparalleled connectivity, modern infrastructure, and thriving commercial activity make it a compelling choice for property investors seeking both short-term rental income and long-term investment growth. Whether you are an experienced investor or just starting, KL Sentral offers numerous opportunities to grow your wealth and secure your financial future. With its constant development and prime location, KL Sentral stands out as a prime investment destination in Kuala Lumpur's dynamic real estate market.

Disclaimer: The following information is provided solely for general knowledge. DWG 博鱼体育官方网站 Sdn Bhd assumes no responsibility or liability for the information's accuracy, adequacy, or reliability. This includes any warranties or representations regarding the suitability of the information for any specific purpose to the maximum extent allowed by law. While every reasonable effort has been made to ensure the information's accuracy, reliability, and completeness at the time of writing, it should not be solely relied upon for making financial, investment, real estate, or legal decisions. It is strongly recommended to seek advice from a qualified professional who can consider your individual circumstances and provide personalized guidance. DWG 博鱼体育官方网站 Sdn Bhd disclaims all liability for any actions taken based on the information provided.

]]>

Saving for a home can be a daunting task, but with the right plan and strategy, you can achieve your #HomeGoal fund. In this beginner's guide, we will explore the steps and considerations to help you on your journey towards your dream home. Whether you're a first-time homebuyer or looking to upgrade, this guide will provide you with valuable insights and tips to build your #HomeGoal fund effectively.

Importance of Setting a #HomeGoal

Before you embark on your savings journey, it's crucial to set a clear #HomeGoal. This goal will serve as your motivation and guide throughout the process. Consider factors such as the type of property you desire, the location, and the estimated cost. Having a specific goal in mind will help you determine how much you need to save and create a realistic savings plan.

Assessing Your Finances

To begin your savings journey, it's essential to assess your current financial situation. Take a close look at your income, expenses, and existing savings. Analyze your monthly budget and identify areas where you can cut back on unnecessary expenses. This will free up more funds to allocate towards your #HomeGoal fund.

Creating a Budget

A budget is a powerful tool that will enable you to track your income and expenses effectively. Start by listing all your income sources and deducting your fixed expenses, such as rent, utilities, and loan repayments. Allocate a portion of your remaining income towards your #HomeGoal fund. Be realistic and ensure that you still have enough for your daily needs and emergencies. Regularly review and adjust your budget as needed.

Saving Strategies

There are several saving strategies that can help you reach your #HomeGoal faster:

Automate your savings: Set up an automatic transfer from your checking account to a separate savings account dedicated to your #HomeGoal fund. This way, you won't be tempted to spend the money and will consistently build your savings.

Cut back on non-essential expenses: Review your discretionary spending and identify areas where you can cut back. Consider reducing dining out, entertainment expenses, and unnecessary subscriptions. Redirect the saved money towards your #HomeGoal fund.

Increase your income: Explore ways to increase your income, such as taking on a side hustle or freelancing. The additional earnings can be directly allocated towards your #HomeGoal fund, accelerating your savings.

Take advantage of employer benefits: Check if your employer offers any benefits or programs that can assist in your home savings journey. This may include matching contributions to a retirement account or offering assistance programs for first-time homebuyers.

Building an Emergency Fund

While saving for your #HomeGoal fund, it's essential to prioritize building an emergency fund. Unforeseen expenses or emergencies can arise, and having a financial safety net will prevent you from dipping into your savings or going into debt. Aim to save at least three to six months' worth of living expenses in an easily accessible emergency fund.

Exploring Financial Assistance Programs

Depending on your location and circumstances, there may be financial assistance programs available to help you achieve your #HomeGoal. Research and inquire about government schemes, grants, or subsidies that can support your savings journey. These programs can provide valuable assistance in accumulating your #HomeGoal fund.

Investing for Your #HomeGoal Fund

If you have a longer savings timeline, consider exploring investment options to grow your #HomeGoal fund. Speak with a financial advisor to assess your risk tolerance and explore investment opportunities that align with your goals. Keep in mind that investments come with risks, and it's essential to diversify your portfolio and seek professional advice.

Monitoring Your Progress

Regularly monitor your progress towards your #HomeGoal fund. Review your savings, track your expenses, and evaluate your budget periodically. Celebrate milestones along the way to stay motivated. If needed, adjust your savings plan or explore additional strategies to ensure you stay on track.

Saving for your dream home requires dedication, discipline, and a well-executed plan. By setting a #HomeGoal, assessing your finances, creating a budget, and implementing effective saving strategies, you can steadily build your #HomeGoal fund. Remember to prioritize building an emergency fund and explore financial assistance programs and investment options to accelerate your savings. With perseverance and smart financial choices, you'll be one step closer to achieving your dream of homeownership

Disclaimer: The following information is provided solely for general knowledge. DWG 博鱼体育官方网站 Sdn Bhd assumes no responsibility or liability for the information's accuracy, adequacy, or reliability. This includes any warranties or representations regarding the suitability of the information for any specific purpose to the maximum extent allowed by law. While every reasonable effort has been made to ensure the information's accuracy, reliability, and completeness at the time of writing, it should not be solely relied upon for making financial, investment, real estate, or legal decisions. It is strongly recommended to seek advice from a qualified professional who can consider your individual circumstances and provide personalized guidance. DWG 博鱼体育官方网站 Sdn Bhd disclaims all liability for any actions taken based on the information provided.

]]>

To obtain favorable loan terms, including faster credit approval, better interest rates, and higher loan amounts, a good credit score is crucial. Before applying for a residential property loan, it's important to consider your credit score as it significantly impacts the interest rate offered by lenders. Your credit score reflects your financial history and helps lenders assess your creditworthiness. A higher credit score indicates lower risk and makes you more favorable to lenders.

In addition to improving your loan options, a good credit score also provides benefits such as faster credit approval, better interest rates, and higher loan amounts. On the other hand, a poor credit score can make it challenging to secure a loan, or you may receive offers with higher interest rates or lower loan amounts.

To achieve an excellent credit score, it is recommended to follow these steps:

Make timely and regular credit payments.

Avoid applying for new credit six months before applying for a mortgage.

Keep your credit card balances below 30% of the credit limit, if possible.

Regularly check your personal credit report for accuracy and update any incorrect information.

Maintaining a healthy repayment history and a reasonable debt-to-credit ratio are the most influential factors when lenders evaluate loan applications. It's crucial to promptly address any errors on your credit report by contacting the lender or utilizing services provided by credit reporting agencies.

Having a diverse credit mix, which includes a combination of different credit products such as credit cards, mortgages, and auto loans, is also beneficial. Demonstrating responsible management of different types of accounts can optimize credit scores and increase the chances of securing loans.

Avoiding certain credit behaviors is crucial. These include missing payments or defaulting on accounts, applying for excessive credit within a short period, and utilizing too much available credit. These behaviors can negatively impact your credit score and make it difficult to secure loans.

It's important to note that credit health is influenced by various factors, and individual circumstances may vary. Seeking guidance from financial professionals or credit reporting agencies can provide personalized advice based on your specific situation.

Addressing common credit score myths, such as the belief that one co-borrower's excellent score can offset the other's weaker score for a joint loan application, is important. Additionally, credit bureaus do not make judgments about credit reports, and it is impossible to hide credit card debt by moving balances around.

It's important to note that credit scores can change over time, and negative information can be improved by making on-time payments, exploring better credit options, and learning about money and credit management. Building a credit history is essential, as some lenders may not lend to individuals without a credit history.

Improving credit scores involves responsible financial management. According to recent studies, average credit scores have shown a positive trend. However, lenders consider other factors such as monthly income, debt service ratio, public record data, and their own lending policies when evaluating mortgage applications.

Disclaimer: The following information is provided solely for general knowledge. DWG 博鱼体育官方网站 Sdn Bhd assumes no responsibility or liability for the information's accuracy, adequacy, or reliability. This includes any warranties or representations regarding the suitability of the information for any specific purpose to the maximum extent allowed by law. While every reasonable effort has been made to ensure the information's accuracy, reliability, and completeness at the time of writing, it should not be solely relied upon for making financial, investment, real estate, or legal decisions. It is strongly recommended to seek advice from a qualified professional who can consider your individual circumstances and provide personalized guidance. DWG 博鱼体育官方网站 Sdn Bhd disclaims all liability for any actions taken based on the information provided.

]]>

The practice of offering "free legal fees" as a promotional incentive in the real estate market is not as straightforward as it may seem.

Typically, this offer implies that the developer will cover the legal fees associated with the sale and purchase agreement (SPA).

However, it is important to understand that this does not include additional expenses like stamp duties, search fees, registration fees, printing charges, and document costs, which the buyer is still responsible for.

In reality, the concept of "free legal fees" in the housing industry is often misunderstood.

When developers make this offer, they usually recommend a law firm from their panel to handle the SPA and related transactions. The same law firm is also tasked with handling the loan documentation.

If the buyer chooses this recommended law firm, the developer will supposedly cover the legal fees. However, it's important to note that in this arrangement, the law firm primarily represents the developer's interests and not the buyer's.

This means that the buyer does not have a dedicated solicitor to protect their rights and interests in the agreement.

Many buyers only realize this when a dispute arises with the developer and they seek assistance from the solicitor, only to find out that the solicitor is actually representing the developer's interests.

In essence, the buyer is left without legal representation.

If the buyer decides to appoint their own solicitor who is not on the developer's panel, the offer of "free legal fees" is affected.

In this scenario, the buyer's solicitor will review the SPA on their behalf and act in the buyer's best interest. However, this means that both the developer and the buyer will have separate solicitors, each with their own associated fees.

If the buyer is unrepresented by a solicitor in the SPA, the offer of "free legal fees" is not truly "free" since the buyer does not have legal representation and therefore has no legal fees to pay.

To complicate matters further, developers often argue that the offer of "free legal fees" is contingent upon the buyer choosing a solicitor from the developer's panel.

This raises questions about the legitimacy of the offer, and developers may face legal repercussions for misrepresentation and damages if they refuse to pay for the buyer's legal representation.

Under the Legal Profession Act 1976, it is stated that a solicitor who acts for the developer in a housing property sale must not act for the buyer in the same transaction. Additionally, the SPA stipulates that both the developer and the buyer are responsible for their respective solicitor's costs.

Considering these legal provisions, one must carefully consider the implications of the developer's offer of "free legal fees."

Disclaimer: The following information is provided solely for general knowledge. DWG 博鱼体育官方网站 Sdn Bhd assumes no responsibility or liability for the information's accuracy, adequacy, or reliability. This includes any warranties or representations regarding the suitability of the information for any specific purpose to the maximum extent allowed by law. While every reasonable effort has been made to ensure the information's accuracy, reliability, and completeness at the time of writing, it should not be solely relied upon for making financial, investment, real estate, or legal decisions. It is strongly recommended to seek advice from a qualified professional who can consider your individual circumstances and provide personalized guidance. DWG 博鱼体育官方网站 Sdn Bhd disclaims all liability for any actions taken based on the information provided.

]]>

The real estate landscape in 2023 showcases a robust and resilient housing market, marked by significant trends and factors that contribute to its strength. In this comprehensive guide, we delve into the reasons behind the continued vitality of the housing market, exploring key aspects and providing insights that are both informative and easily understandable.

1. Low Mortgage Rates

One of the primary factors fueling the strength of the housing market is the presence of low mortgage rates. In 2023, homebuyers continue to benefit from historically low interest rates, making homeownership more accessible and attractive. These favorable rates stimulate demand, fostering a dynamic real estate environment.

Frequently Asked Questions (FAQs):

Q1: How do low mortgage rates impact the housing market?

A1: Low mortgage rates make borrowing more affordable, encouraging prospective homebuyers to enter the market, thereby increasing demand for homes.

Q2: Are low mortgage rates expected to persist in the coming months?

A2: While market conditions can change, experts predict that low mortgage rates will likely persist in the near future, sustaining the momentum in the housing market.

2. Strong Economic Fundamentals

The housing market's resilience is further underpinned by strong economic fundamentals. A robust job market, increasing wages, and overall economic growth contribute to consumers' confidence and purchasing power. As individuals feel more financially secure, they are more inclined to invest in real estate, driving demand for homes.

FAQs:

Q3: How does a strong job market impact the housing market?

A3: A strong job market enhances consumers' confidence, providing them with the financial stability needed to consider homeownership.

Q4: What role do increasing wages play in the housing market's strength?

A4: Rising wages empower individuals to afford and invest in homes, contributing to the overall health of the real estate market.

3. Limited Housing Inventory

Another key factor influencing the housing market in 2023 is the limited housing inventory. The supply-demand imbalance, with demand outpacing supply, results in increased competition among buyers. Limited inventory often leads to higher property values, benefiting sellers and creating a robust seller's market.

FAQs:

Q5: How does limited housing inventory affect homebuyers?

A5: Limited inventory can create competition among buyers, potentially leading to higher home prices and a faster-paced market.

Q6: What can potential sellers do in a limited inventory scenario?

A6: Sellers can leverage the market conditions to their advantage by strategically pricing their homes and potentially receiving competitive offers.

4. Technological Advancements in Real Estate

The integration of technology into the real estate industry has significantly impacted the market in 2023. Innovations such as virtual tours, online property listings, and advanced data analytics enhance the home buying and selling process, making it more efficient and convenient for all parties involved.

FAQs:

Q7: How have virtual tours changed the homebuying experience?

A7: Virtual tours allow prospective buyers to explore properties remotely, saving time and providing a more immersive experience.

Q8: Are online property listings a significant trend in the current market?

A8: Yes, online property listings have become a cornerstone of the real estate industry, offering easy access to a wide range of available homes.

5. Shifts in Demographics and Lifestyle Preferences

Changing demographics and evolving lifestyle preferences contribute to the diversification of the housing market. In 2023, the preferences of homebuyers are influenced by factors such as remote work opportunities, urbanization trends, and sustainable living practices.

FAQs:

Q9: How does the rise of remote work impact housing choices?

A9: The increase in remote work has led to a shift in housing preferences, with some individuals opting for homes in suburban or rural areas.

Q10: Are sustainable living practices influencing the housing market?

A10: Yes, there is a growing demand for eco-friendly and sustainable homes, reflecting a broader societal shift towards environmentally conscious living.

In conclusion, the housing market remains strong in 2023, driven by a combination of low mortgage rates, strong economic fundamentals, limited housing inventory, technological advancements, and shifts in demographics and lifestyle preferences. Understanding these key factors empowers both buyers and sellers to navigate the real estate landscape effectively. As the market continues to evolve, staying informed about these trends will be crucial for anyone looking to engage in the dynamic world of real estate.

Disclaimer: The following information is provided solely for general knowledge. DWG 博鱼体育官方网站 Sdn Bhd assumes no responsibility or liability for the information's accuracy, adequacy, or reliability. This includes any warranties or representations regarding the suitability of the information for any specific purpose to the maximum extent allowed by law. While every reasonable effort has been made to ensure the information's accuracy, reliability, and completeness at the time of writing, it should not be solely relied upon for making financial, investment, real estate, or legal decisions. It is strongly recommended to seek advice from a qualified professional who can consider your individual circumstances and provide personalized guidance. DWG 博鱼体育官方网站 Sdn Bhd disclaims all liability for any actions taken based on the information provided.

]]>

If you're contemplating whether to make that leap into property ownership, consider this your sign. In this era of dynamic market trends, there are compelling reasons why buying a property now is a strategic move that can shape your financial future positively. Let's delve into the six key factors that make this the opportune moment to invest in real estate.

1. Market Momentum: Seize the Advantage

The real estate market is a living organism, constantly evolving and responding to various factors. Currently, the market is showing favorable momentum, with increasing demand and limited supply in many regions. By entering the market now, you position yourself to benefit from this momentum, potentially witnessing the value of your investment grow substantially.

2. Historically Low Interest Rates: Unlock Cost Savings

One of the most significant advantages of buying property now is the historically low interest rates prevailing in the financial landscape. Low-interest rates translate to more affordable mortgages, allowing you to secure a property with reduced financing costs. Seizing this opportunity enables you to maximize your investment while minimizing financial burdens.

3. Build Equity: Your Property, Your Wealth

Real estate is a tangible asset that has the unique advantage of building equity over time. As property values appreciate and your mortgage decreases, you're essentially creating a wealth-building mechanism. By investing in real estate today, you kickstart this equity-building process, establishing a solid financial foundation for the future.

4. Tax Benefits: Optimize Your Finances

The tax advantages associated with property ownership are often underestimated. By becoming a property owner, you open the door to various tax benefits, including deductions on mortgage interest, property taxes, and even certain expenses related to property management. These tax advantages can significantly optimize your overall financial strategy.

5. Diversify Your Investment Portfolio: Spread the Risk

Diversification is a fundamental principle in investment strategy, and real estate offers an excellent avenue to achieve this. Adding property to your investment portfolio helps spread risk across different asset classes, reducing the impact of market fluctuations on your overall financial health. It's a strategic move to ensure stability and resilience in your investment portfolio.

6. Rental Income Potential: Turn Property into Profits

Investing in real estate not only holds the promise of property appreciation but also the potential for generating rental income. With the demand for rental properties on the rise, especially in growing urban centers, you can transform your property into a lucrative income stream. This dual benefit of appreciation and rental income enhances the overall return on investment.

Seize the Opportunity, Secure Your Future

In conclusion, the current real estate landscape presents a unique window of opportunity for savvy investors. By acting now, you position yourself to capitalize on market momentum, leverage historically low interest rates, build equity, enjoy tax benefits, diversify your investment portfolio, and tap into the lucrative rental market. Seize the opportunity, make an informed investment decision, and set the stage for a financially secure future.

Disclaimer: The following information is provided solely for general knowledge. DWG 博鱼体育官方网站 Sdn Bhd assumes no responsibility or liability for the information's accuracy, adequacy, or reliability. This includes any warranties or representations regarding the suitability of the information for any specific purpose to the maximum extent allowed by law. While every reasonable effort has been made to ensure the information's accuracy, reliability, and completeness at the time of writing, it should not be solely relied upon for making financial, investment, real estate, or legal decisions. It is strongly recommended to seek advice from a qualified professional who can consider your individual circumstances and provide personalized guidance. DWG 博鱼体育官方网站 Sdn Bhd disclaims all liability for any actions taken based on the information provided.

]]>

Embarking on a home renovation journey can be both exciting and daunting. As a property enthusiast, delving into the details of house renovation costs in 博鱼体育官方网站 is a fascinating venture. Let's navigate through the intricacies and unveil the secrets that lay behind the financial curtain of transforming your living space.

1.0 The Starting Line: Decoding the Essentials

First things first, understanding the core elements that influence house renovation costs is crucial. We're not just talking about the obvious expenses like materials and labor; there's a tapestry of factors woven into the final cost. From the type of renovation to the choice of materials, every decision comes with its own price tag.

Low Budget Renovation (RM20,000 to RM30,000)

Average Renovation Cost 博鱼体育官方网站 (RM31,000 to RM60,000)

High Budget Renovation (RM60,000 and above)

Renovation Type

The scope of your renovation project significantly impacts the overall cost. Whether it's a simple cosmetic upgrade or a complete overhaul, each has its own set of financial implications. Consider your goals and budget carefully before diving in.

Material Matters

The materials you choose can make or break your budget. From basic to high-end options, each material comes with its own price point. Balancing aesthetics with cost-effectiveness is the name of the game.

Labor Expenses

Skilled craftsmanship comes at a price. Understanding labor costs and negotiating fair deals are essential steps. Remember, the quality of workmanship directly affects the longevity and appeal of your renovated space.

2.0 The Budgeting Puzzle: Cracking the Code

Now that we've identified the key players let's unravel the mystery of budgeting. Crafting a realistic budget involves careful consideration of each element, ensuring you don't break the bank while pursuing your dream renovation.

Research Pays Off

Before diving into the renovation rabbit hole, conduct thorough research. Explore different materials, compare labor costs, and get a sense of the prevailing market rates. Knowledge is your best ally when crafting a budget that aligns with your vision.

Contingency Cushion

In the unpredictable world of renovations, surprises are inevitable. Hidden structural issues or unexpected delays can throw a wrench into your plans. Allocating a contingency fund cushions the financial impact of unforeseen challenges.

DIY vs. Professional Help

While the allure of DIY projects is undeniable, it's essential to evaluate your skills realistically. Some tasks may be well-suited for a DIY approach, while others demand professional expertise. Balancing these choices can significantly impact your overall expenses.

3.0 The Grand Finale: Navigating the Financial Landscape

As we approach the climax of our renovation journey, let's address the financial landscape with clarity and confidence.

Financing Options

Exploring financing options opens doors to possibilities you might not have considered. From personal loans to home renovation grants, understanding the financial avenues available empowers you to make informed decisions.

Return on Investment

A well-thought-out renovation not only enhances your living space but can also add value to your property. Consider the potential return on investment when making choices. Opting for timeless designs and quality materials ensures your investment stands the test of time.

The Personal Touch

While we've delved into the technicalities, don't forget the personal touch. Your home is a reflection of your style and personality. Infuse your unique flair into the renovation process, creating a space that resonates with you on a personal level.

In conclusion, navigating the house renovation costs in 博鱼体育官方网站 is a journey of discovery and decision-making. From understanding the intricacies of expenses to crafting a budget that aligns with your vision, every step is an opportunity to create a home that not only meets your needs but exceeds your expectations. Happy renovating!

Disclaimer: The following information is provided solely for general knowledge. DWG 博鱼体育官方网站 Sdn Bhd assumes no responsibility or liability for the information's accuracy, adequacy, or reliability. This includes any warranties or representations regarding the suitability of the information for any specific purpose to the maximum extent allowed by law. While every reasonable effort has been made to ensure the information's accuracy, reliability, and completeness at the time of writing, it should not be solely relied upon for making financial, investment, real estate, or legal decisions. It is strongly recommended to seek advice from a qualified professional who can consider your individual circumstances and provide personalized guidance. DWG 博鱼体育官方网站 Sdn Bhd disclaims all liability for any actions taken based on the information provided.

]]>

Unveiling the Secrets: Ensuring a Safe Property Investment

Investing in real estate is a significant decision, and safeguarding your interests is paramount. Whether you're a seasoned investor or a first-time homebuyer, follow these crucial steps to ensure a secure property purchase.

1.0 Legal Documents: A Thorough Review

The cornerstone of any property transaction is the sales and purchase agreement. Delve into the fine print, understanding each clause. Employing a dedicated lawyer safeguards your interests; however, avoid using the same legal representation as the developer. Vigilance during this stage ensures a smooth and secure property acquisition.

Land Title Investigation: A Necessity

Prioritize a meticulous examination of the land title. Armed with details like title number, type, mukim/pekan/bandar, district, and state, conduct a land search. Uncover vital information such as land ownership, title type, and any restrictions or encumbrances. Master the art of a land title search to make informed decisions.

On-Site Verification: Eyes on the Ground

For local properties, physically visit the site of the planned development. While many buyers limit themselves to sales galleries, witnessing the actual site provides insights into construction progress and the neighborhood. Confirm that reality aligns with the promises made by the developer.

4.0 Survey Developers with Precision

When embarking on your property journey, the first checkpoint is the developer's credibility. Look for a valid Application for Advertising Permit and Developer鈥檚 License (APDL) from KPKT. The license number, usually nestled in the sales brochure's fine print, authenticates the developer's legitimacy.

5.0 Beware of Blacklisted Developers

Dive deeper into due diligence by checking for blacklisted developers. KPKT maintains a list of developers penalized under the Housing Development (Control and Licensing) Act 1966. Access this information on the National Housing Department website, ensuring you steer clear of potential pitfalls.

Conclusion: Empower Your Property Purchase

In conclusion, these meticulous steps act as your armor in the complex realm of real estate. Prioritize due diligence, consult professionals when needed, and empower yourself as a savvy property buyer. Your investment journey deserves nothing less than a secure and informed approach.

Disclaimer: The following information is provided solely for general knowledge. DWG 博鱼体育官方网站 Sdn Bhd assumes no responsibility or liability for the information's accuracy, adequacy, or reliability. This includes any warranties or representations regarding the suitability of the information for any specific purpose to the maximum extent allowed by law. While every reasonable effort has been made to ensure the information's accuracy, reliability, and completeness at the time of writing, it should not be solely relied upon for making financial, investment, real estate, or legal decisions. It is strongly recommended to seek advice from a qualified professional who can consider your individual circumstances and provide personalized guidance. DWG 博鱼体育官方网站 Sdn Bhd disclaims all liability for any actions taken based on the information provided.

]]>

Property taxes in 博鱼体育官方网站 are levied on the ownership, transfer, and use of property. Each type of property tax has its own unique characteristics, such as the type of property it is imposed on, the rate of taxation, and the frequency of payment.

For anyone who is an existing homeowner or looking to buy a new home, we have compiled a handy list of the different types of property taxes in 博鱼体育官方网站 with references on detailed explanations of their key features and how they are calculated.

Memorandum of Transfer refers to the legal document used to transfer ownership of a property from the seller to the buyer. It is a crucial part of property transactions in 博鱼体育官方网站 and often involves specific taxes and fees.

Read more: /property-guides/what-is-memorandum-of-transfer-mot-in-malaysian-property

SPA Stamp Duty stands for Sales and Purchase Agreement Stamp Duty. It is a tax levied on the agreement made between the property buyer and seller. This tax is paid based on the property's purchase price, and it is a mandatory part of property transactions.

Read more:

LA Stamp Duty is a tax applied to the legal agreements associated with property loans. This duty is levied on the agreements made between borrowers and lending institutions (banks), typically calculated based on the loan amount.

Read more:

Quit Rent, known as "Cukai Tanah" in 博鱼体育官方网站, is an annual tax levied by the state government on landowners. It is typically a modest fee for the right to hold land and varies depending on the type and location of the property.

Read more: /property-guides/quit-rent-parcel-rent-and-assessment-rates

Parcel Rent, or "Cukai Petak," is a specific form of land tax applicable to property developments with individual parcels or lots (strata title). This tax is levied based on the size and value of each parcel within a development.

Read more: /property-guides/quit-rent-parcel-rent-and-assessment-rates

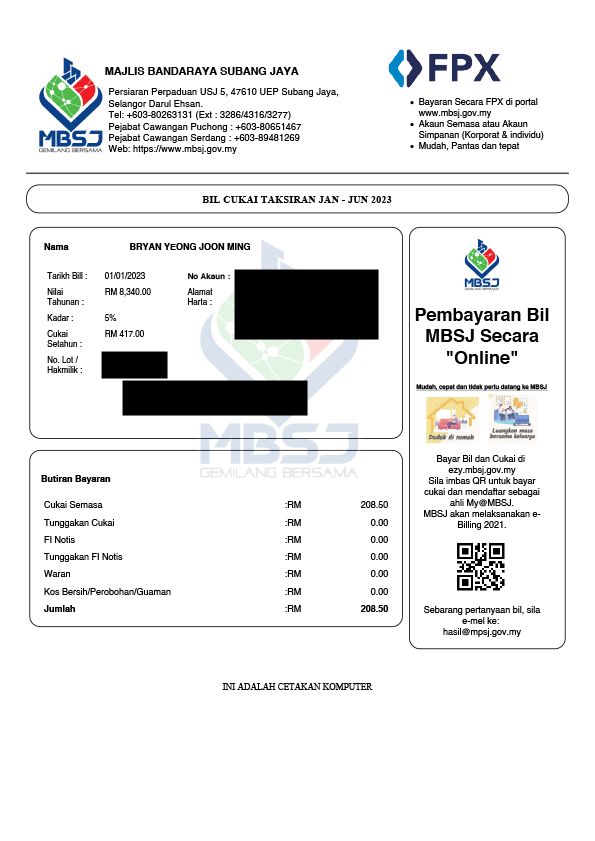

6.0 Assessment Rates (Cukai Taksiran / Cukai Pintu)

Assessment Rates, known as "Cukai Taksiran" or "Cukai Pintu," are property taxes collected by local authorities (usually municipal councils). They are based on the estimated annual rental value of a property and are used to fund local services and infrastructure.

Read more: /property-guides/quit-rent-parcel-rent-and-assessment-rates

7.0 Real Property Gain Tax (RPGT)

Real Property Gain Tax, often abbreviated as RPGT, is a capital gains tax imposed on profits earned from the disposal of real property. This tax is payable by property sellers and is calculated based on the property's market value and the holding period.

Read more: /property-guides/what-is-real-property-gains-tax-rpgt-in-malaysia

Rental Income Tax is a tax levied on the rental income earned by property owners and landlords. It is part of the individual's taxable income and is subject to 博鱼体育官方网站's income tax regulations.

Read more:

Disclaimer: The following information is provided solely for general knowledge. DWG 博鱼体育官方网站 Sdn Bhd assumes no responsibility or liability for the information's accuracy, adequacy, or reliability. This includes any warranties or representations regarding the suitability of the information for any specific purpose to the maximum extent allowed by law. While every reasonable effort has been made to ensure the information's accuracy, reliability, and completeness at the time of writing, it should not be solely relied upon for making financial, investment, real estate, or legal decisions. It is strongly recommended to seek advice from a qualified professional who can consider your individual circumstances and provide personalized guidance. DWG 博鱼体育官方网站 Sdn Bhd disclaims all liability for any actions taken based on the information provided.

]]>

When you buy a property in 博鱼体育官方网站, you may be surprised to learn that there are other costs involved besides the purchase price and monthly mortgage payments. These "hidden" or, perhaps more often, 鈥渙verlooked鈥� costs can add up over time, so it's important to be aware of them before purchasing a property.

The three most common "hidden" costs of homeownership in 博鱼体育官方网站 are quit rent, parcel rent, and assessment rates. The taxes collected by the state government and local town councils are often calculated based on the value of your property.

Quit Rent

What is Quit Rent?

Quit rent, also known as Cukai Tanah, is a land tax imposed on property owners by local state governments in 博鱼体育官方网站 via the country鈥檚 Land Office. It's a payment made in exchange for the right to occupy and utilize the land on which the property is built.

According to the , all landed property owners, including both residential and commercial property owners, must pay quit rent to the respective state governments.

Quit rent is usually payable annually, once a year, and the due date varies from state to state in 博鱼体育官方网站, but most states have a cut-off date of 31 May.

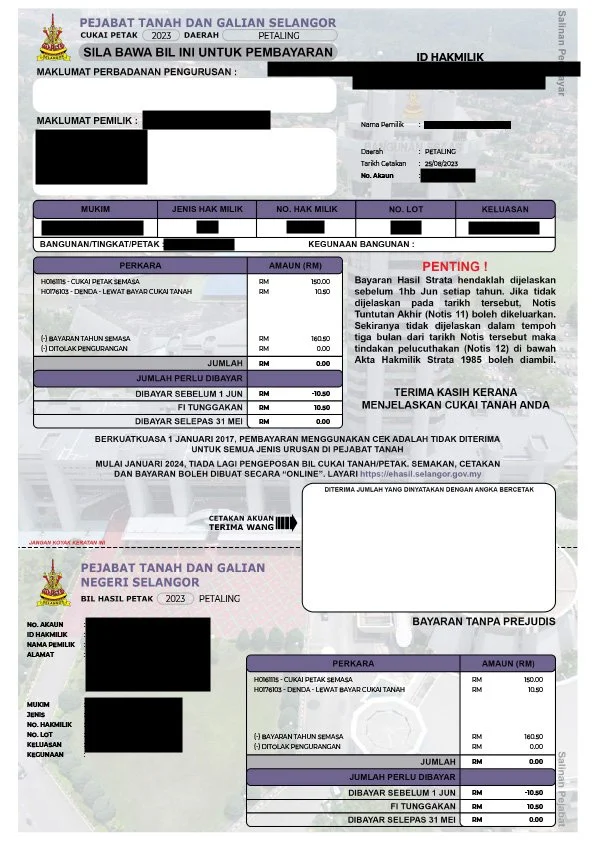

Example of a quit rent bill:

How is Quit Rent Calculated?

Quit rent is a land tax imposed on owners of landed properties. It is calculated by multiplying the size of the property in square feet (sq ft) by the quit rent rate.

Here is the formula for calculating Quit Rent:

SQ.FT OF PROPERTY x QUIT RENT RATE = QUIT RENT AMOUNT

2,500 SQ.FT x RM 0.035 PSF = RM 87.50

It is important to note that the quit rent rate may vary depending on the property's location.

Parcel Rent

What is Parcel Rent?

Parcel Rent, also called Cukai Petak, serves a similar purpose to Quit Rent but applies specifically to owners of strata properties. Strata properties are properties that have been divided into smaller units, known as parcels, such as apartments, condominiums, or townhouses.

Interestingly, Parcel Rent was originally Quit Rent. In the past, a master quit rent for strata properties was charged to the property's joint management body (JMB). The JMB would charge the cost of the quit rent to the parcel owners through maintenance fees.

However, in June 2018, Parcel Rent was introduced by Selangor, followed by Penang in 2019, then Kuala Lumpur in 2020, where the tax is now charged directly to the parcel owners instead of the JMB. This change was made to make selling and transferring ownership of strata properties easier. Similar to Quit Rent, Parcel Rent is usually payable annually.

Example of a parcel rent bill:

How is Parcel Rent Calculated?

Parcel rent is calculated based on the size of the property. This is where Parcel Rent made a huge difference in costs compared to when it was Quit Rent.

Quit Rent for Strata Properties (Previous formula):

(SQ.FT OF PROPERTY x QUIT RENT RATE) / NO. OF PARCELS = QUIT RENT AMOUNT

(10,000 SQ.FT x RM 0.035 PSF) / 10 UNITS = RM 35

Parcel Rent for Strata Properties (Current formula):(SQ.FT OF PROPERTY x QUIT RENT RATE) = QUIT RENT AMOUNT

(10,000 SQ.FT x RM 0.035 PSF) = RM 350

For example, if the property of 10,000 sq.ft has 10 units, the 鈥榤aster鈥� quit rent will be charged to the JMB at RM 350, which will then be distributed to 10 parcel owners at RM 35 each in the form of maintenance fees. Meanwhile, Parcel Rent will be charged directly to all 10 parcel owners at RM 350 each.

Yes, that means the cost of homeownership has suddenly increased a lot for strata property owners under the current Parcel Rent compared to when it was still under Quit Rent previously.

Assessment Rates

What are Assessment Rates?

Assessment rate, also known as Cukai Pintu / Cukai Taksiran, is a local land tax collected by local councils to pay for developing and maintaining local infrastructure and services. This tax is essentially a charge to maintain the local area, such as:

Street lighting: This ensures that the streets are well-lit at night, making it safer for pedestrians and motorists.

Park maintenance: This includes tasks such as mowing the grass, trimming the trees, and removing litter.

Waste collection: This ensures that the garbage is collected regularly and disposed of properly.

Other miscellaneous tasks: This includes things like maintaining public toilets, cleaning drains, and repairing potholes.

Example of an assessment rate bill:

All property owners in 博鱼体育官方网站 must pay assessment rates, regardless of whether the property is residential, commercial, or industrial. This includes owners of bungalows, apartments, condominiums, factories, and other types of properties.

Even if you are renting out your property, you are still responsible for paying assessment rates. The tenant is not responsible for paying assessment rates.

Assessment rates are typically billed and payable annually, semi-annually, or quarterly, depending on the local authority's policies.

How are Assessment Rates Calculated?

Assessment rates are calculated based on your property's estimated annual rental value.

The estimated annual rental value is the amount your property would rent for if rented out on the open market. It is calculated by the local authority based on several factors, including the size of your property, the location of your property, and the type of property.

Once the estimated annual rental value is calculated, a set percentage rate is applied to determine the assessment rate you owe. The percentage rate differs from different states, but the general rate for 博鱼体育官方网站 is 4% of the annual rental value of your property.

Here is the formula for calculating Assessment Rates:

ESTIMATED ANNUAL RENTAL VALUE (ESTIMATED MONTHLY RENTAL VALUE X 12) x PERCENTAGE RATE = ASSESSMENT RATES

(RM 2,500 x 12) x 4% = ASSESSMENT RATES

RM 30,000 x 4% = RM 1,200

For example, if your property's estimated annual rental value is RM30,000 (RM 2,500/month), you would owe RM 1,200 in the assessment rate. This is calculated by taking 4% of RM 30,000, the guideline percentage rate for landed properties in 博鱼体育官方网站.

Based on the sample above, assessment rates are collected over two payments across the year, which would be RM 600 per payment.

The payment schedule may vary by state, so it is essential to check with your local authority to determine your property's specific assessment rate requirements.

Can you choose not to pay Quit Rent, Parcel Rent, or Assessment Rates in 博鱼体育官方网站?

As much as we probably wish to 鈥渄on鈥檛 know about it, hence, it does not exist鈥�, failing to pay quit rent, parcel rent, or assessment rates in 博鱼体育官方网站 is similar to avoiding income tax. It can have serious consequences, including:

A notice of arrears and a penalty charge.

Arrest and the confiscation of your belongings.

The seizure and auctioning off of your property.

The authorities have the power to track down and seize your property if you don't pay your land taxes.

How To Pay Quit Rent, Parcel Rent, Or Assessment Rates

There are several ways to pay your quit rent, parcel rent, and assessment rates in 博鱼体育官方网站, depending on your state.

Offline and in-person:

Land Registry Office: This is the most common way to pay land taxes. You can find the address of your local Land Registry Office's address on the Ministry of Finance 博鱼体育官方网站 website.

Local district council: You can also pay your land taxes at your local district council office. Your local district council's address can be found on your state government's website.

Post offices: You can pay your land taxes at any post office in 博鱼体育官方网站.

Online:

Pos Online: Pos 博鱼体育官方网站 offers an online payment service for land taxes. You can pay your land taxes using your credit card or debit card.

Online banking platforms: Most major banks in 博鱼体育官方网站 offer online payment services for land taxes. You can pay your land taxes using your online banking account.

The Land Registry Office鈥檚 official online platform: Some Land Registry Offices have their own online payment platforms. You can find the link to the online payment platform on the website of your Land Registry Office.

Practical Tips for Property Owners

Managing and Budgeting: Incorporate these costs into your budget to ensure timely payments and avoid financial strain.

Government Agencies Contact Information: Keep a record of the relevant government agencies responsible for collecting these taxes. Stay informed about any changes in contact information or procedures.

Avoiding Late Payment Penalties: Set up reminders to ensure you meet payment deadlines and avoid unnecessary penalties.

In conclusion, being a responsible property owner involves more than just the initial investment 鈥� it entails managing ongoing costs and fulfilling legal obligations. By understanding and effectively managing quit rent, parcel rent, and assessment rates, property owners can contribute to their community's development and ensure a smooth homeownership experience.